owner's draw vs salary uk

Salary decision you need to form your business. You dont need a salary because you.

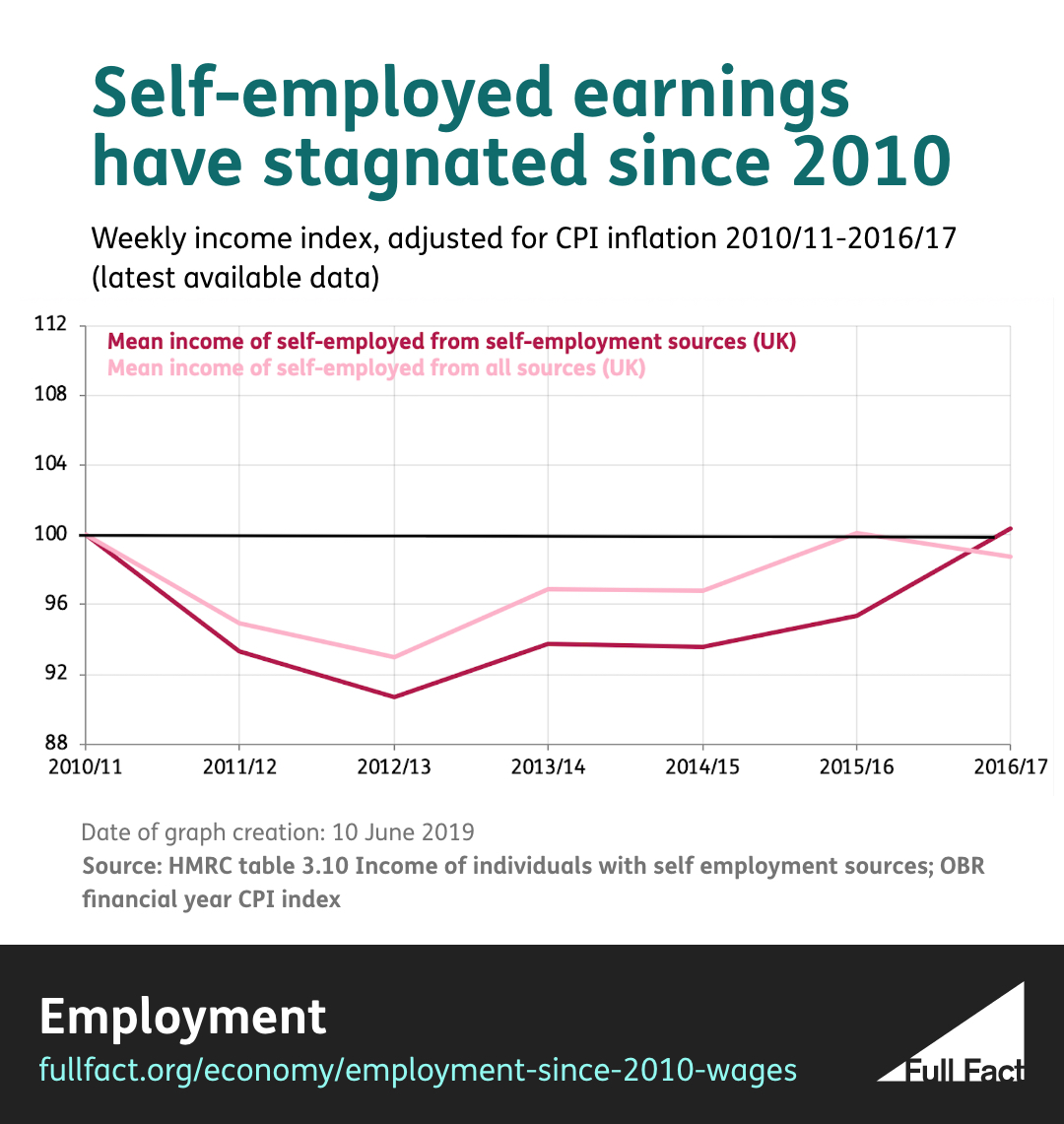

Employment What S Happened To Wages Since 2010 Full Fact

30000 contributions 25000 share of revenue 10000 owners draw 45000 partner equity balance.

. Draws can tie directly to the companys performance. You pay yourself a regular salary just as you would an employee of the. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

Owners draw vs salary uk Monday May 9 2022 Edit. Owners equity refers to your share of your business assets like your initial investment and any profits your business has made. Before you make the owners draw vs.

As mentioned partners cant get a salary since you cant be both an. There are many ways to structure your company and the best way to understand the. On the opposite end S Corps dont pay self-employment tax on.

3 hours ago If you draw 30000 then your owner s equity goes down to 45000. When you pay yourself a salary you decide on a set wage for yourself and pay yourself a fixed amount every. Owners draw vs salary uk.

In the former you draw money from your business as and when you see fit. How to Pay Yourself as a Business Owner. For example if you invested 50000 into your.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Updated on December 11 2020 November 20 2020. First lets take a look at the difference between a salary and an owners draw.

Owners draw vs salary uk Tuesday January 11 2022 Edit. Since owner draws are discretionary youll have the flexibility to take out more or fewer funds based on how the business is doing. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

With owner s draw you have to pay. A salary on the other hand is a set recurring. First lets take a look at the difference between a salary and an owners draw.

Your two payment options are the owners draw method and the salary method. Technically an owners draw is a distribution from the owners equity account an account that represents the owners investment in the business. Small business owners paying themselves a salary collect a W-2 and pay those taxes through wage withholdings.

The owners draw method offers a greater level of flexibility than the salary method. Owners Draw vs. Pros and Cons of Owners Draw vs.

For example if you invested 50000 into. People Leave Managers Not Companies Gallup Finds Approachable Is Essential This Or That Questions Fun Questions. Business Growth Hacks.

Exclusive Gender Gap Dominates Latest Arts Pay Figures News Artsprofessional

How To Pay Yourself From An Llc 2022 Guide Forbes Advisor

Mohamed Salah S Plaudits Mean Nothing Until They Are Backed Up With A Liverpool Salary To Befit His Talent The Independent

How To Pay Yourself As A Business Owner Gusto Resources

Sole Trader Drawings Or Wages The Answer Is Fairly Simple

How To Pay Yourself As A Business Owner In The Uk Freshbooks Blog

Business Owner Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Quickbooks Uk

How To Account For Owner S Equity On Your Balance Sheet

Willow Creek Press Just Shiba Inus 2023 Wall Calendar Petco

People And Skills Report 2022 Tech Nation

Drawings Vs Wages What S The Best Way To Pay Yourself

How Academia Resembles A Drug Gang Impact Of Social Sciences

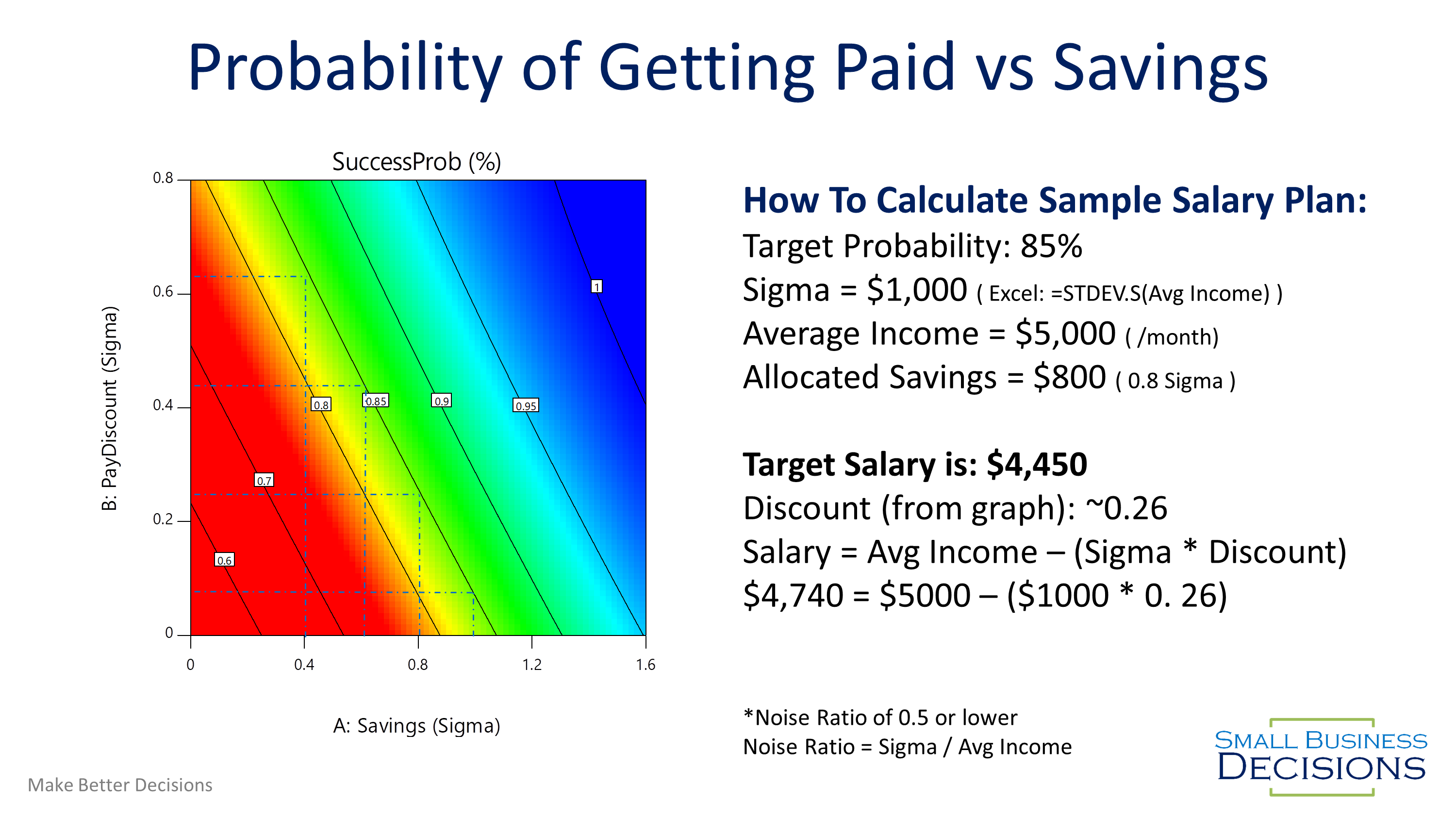

How Much Can You Pay Yourself As A Business Owner Small Business Decisions

How To Pay Yourself As A Business Owner In The Uk Freshbooks Blog

How To Pay Yourself When You Own A Business

If Tranfering My Wages From My Business Account To Personal Sole Trader How Do I Record It As A Wage So Quick Books Still Deducts My Tax Rather Than An Expense

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube