franklin income fund class c fact sheet

See fees data for Franklin Income Fund FCISX. Find the latest Franklin Income Fund Class C FCISX stock quote history news and other vital information to help you with your stock trading and investing.

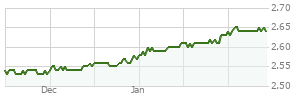

Research current and historical price charts top holdings management and full profile.

. Forms Applications. Advisor Performance Growth of a 10000 Investment from 04031985-09302020 72500 Advisor. Mutual Funds Retirement Investing Solutions.

Quote Fund Analysis Performance Sustainability Risk. Start a 14-day free trial to Morningstar Premium to unlock our. Current performance may be lower or higher than performance shown.

See the prospectus for details. Ad Choose From Over 70 Funds With 4 5 Star Ratings From Morningstar. Get quote details and summary for Franklin Income FundC FCISX.

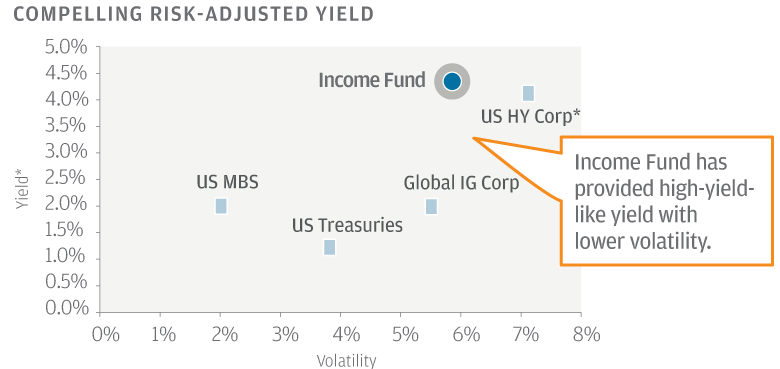

Learn About Our Approach. As of September 2021 in fact the strategy held less than 4 of its assets in nonutilities stocks and just 6 in foreign fare whereas. A single-page data sheet describing the Franklin Income Funds objective portfolio holdings and performance.

Franklin CA Tax Free Income C. Research information including fund fees cost projections and minimum investments for Franklin Income Fund. Analyze the Fund Franklin Income Fund Class C having Symbol FCISX for type mutual-funds and perform research on other mutual funds.

Franklin Minnesota Tax-Free Income Fund September 30 2020 Composition of Fund. Fund Fact Sheet Share Class. Quantitative rating as of Jan 31 2022.

See Franklin Income Fund FCISX mutual fund ratings from all the top fund analysts in one place. A single-page data sheet describing the Franklin Growth Funds objective portfolio holdings and performance. Class A 353 496 490 FKIQX Maximum Sales Charges Class A 375 initial sales charge Total Annual Operating Expenses With Waiver Without Waiver Class A 071 072 30-Day SEC Yieldb With Waiver Without Waiver Class A 208 208 Fund Description The fund seeks to maximize income while maintaining prospects for capital appreciation by.

Franklin Strategic Income benefits from a well-resourced staff but it has yet to prove an advantage relative to peers especially given its. They are usually only set in response to actions made by you which amount to a request for services such as setting your privacy preferences logging in or filling in forms. The maximum offering price MOP returns take into account the contingent deferred sales charge CDSC for Class C shares which for this fund is 100.

Learn about FCISX with our data and independent analysis including NAV star rating asset allocation capital gains and dividends. See Franklin Income Fund performance holdings fees risk and other data from Morningstar SP. For 457b and certain 403b plans Class C share funds are not available.

Effective October 1 2020 the funds primary benchmark is 6535 SP 500 IndexBloomberg Barclays US. These cookies are necessary for the website to function and cannot be switched off in our systems. Franklin Templeton uses cookies to analyse website usage personalise your website experience and assist in our.

Market Volatility Resources. 198585 30-DaySECYield ShareClass WithWaiver WithoutWaiver A 124 124 C 056 056 MaximumSalesCharge ClassA550initialsalescharge ClassC100contingentdeferredsalescharge CDSCinthefirstyearonly FundMeasures StandardDeviation3 Yrs-ClassA 1665 Beta3YrsvsRussell 1000ValueIndex-ClassA 086.

Q4 2020 Top Fixed Income Mutual Funds Investmentnews

Franklin Income Fund Class A1 Fkinx Latest Prices Charts News Nasdaq

Franklin Income Fund Class A1 Fkinx Latest Prices Charts News Nasdaq

Jpmorgan Income Fund A J P Morgan Asset Management

Franklin Income Fund Class A1 Fkinx Latest Prices Charts News Nasdaq

Franklin Income Fund Class A1 Fkinx Latest Prices Charts News Nasdaq

Putnam Tax Exempt Income Fund Ptaex Putnam Investments

Franklin Income Fund Class C Fcisx

Franklin Income Fund Class A1 Fkinx Latest Prices Charts News Nasdaq

Franklin Income A1 Fkinx Quote Morningstar

Understanding Income Taxes Visual Ly Income Tax Business Tax Tax Preparation

Franklin Income Fund Class C Fcisx

/sirjohntempleton_final-99ee17d1ca914557a3066caaca4329bb.png)